Budgeting is one of the most important steps toward achieving financial stability, yet many people struggle with finding a system that works for them. The 50/30/20 rule offers a simple, effective framework for managing your money without the complexity of tracking every dollar. In this beginner’s guide, we’ll break down the 50/30/20 rule, how it works, and how you can use it to create a realistic budget and reach your financial goals.

What Is the 50/30/20 Rule?

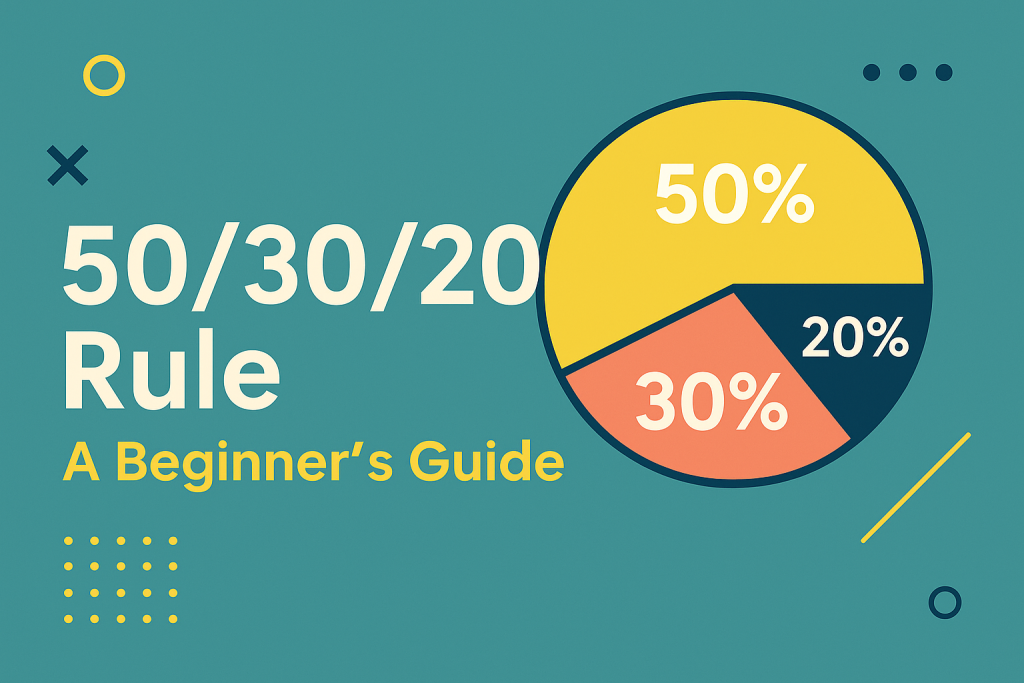

The 50/30/20 rule is a budgeting method that divides your after-tax income into three main categories:

- 50% for Needs: Essential expenses like housing, utilities, groceries, and insurance

- 30% for Wants: Non-essential spending such as dining out, entertainment, and hobbies

- 20% for Savings and Debt Repayment: Financial goals like saving for retirement, building an emergency fund, and paying off debts

This budgeting basics formula is designed to keep your spending in check while still allowing for flexibility and enjoyment in your life.

Why the 50/30/20 Rule Works

The simplicity of the 50/30/20 rule makes it appealing for beginners. By focusing on broad categories rather than individual expenses, it reduces the stress of budgeting and helps you prioritize what matters most. It’s a practical starting point for anyone looking to improve their money management skills without getting overwhelmed by complicated spreadsheets.

Helps Prioritize Needs and Wants

Many people struggle with distinguishing between needs and wants. The 50/30/20 rule encourages you to think critically about your spending habits. For example, housing and utilities are non-negotiable needs, while a streaming subscription or dining out falls under wants. By following this method, you can make more intentional spending decisions that align with your financial goals.

Encourages Saving and Debt Repayment

Allocating 20% of your income to savings and debt repayment ensures that you’re making consistent progress toward long-term financial stability. Whether it’s building an emergency fund, contributing to retirement accounts, or paying off loans, this portion of your budget is key to improving your financial health over time.

How to Apply the 50/30/20 Rule

Step 1: Calculate Your After-Tax Income

Start by determining your monthly take-home pay after taxes and deductions. This is the base number you’ll use for budgeting. For example, if your after-tax income is $4,000 per month, the 50/30/20 breakdown would be:

- 50% Needs = $2,000

- 30% Wants = $1,200

- 20% Savings/Debt = $800

Step 2: Categorize Your Expenses

Review your current spending and sort it into the three categories: needs, wants, and savings/debt repayment. This process may reveal areas where you’re overspending on wants, or where you can cut back to increase your savings rate.

Step 3: Adjust as Needed

While the 50/30/20 rule offers a great starting point, it’s important to tailor it to your unique situation. For instance, if you live in a high-cost area, your needs may take up more than 50% of your budget. In that case, you can adjust the percentages to fit your lifestyle while still aiming to save and manage your money wisely.

Tips for Success with the 50/30/20 Rule

- Automate your savings and debt payments to ensure consistency

- Review your budget monthly and make adjustments as needed

- Be honest about your wants vs. needs to avoid overspending

- Use budgeting tools or apps to track your progress and stay accountable

Final Thoughts

The 50/30/20 rule is an excellent budgeting guide for anyone looking to simplify their money management routine. By dividing your income into needs, wants, and savings, you can create a balanced approach to spending that supports your long-term financial goals. Remember, budgeting isn’t about restricting your lifestyle—it’s about creating a plan that works for you. Start small, stay consistent, and watch your financial health improve over time.